Many people do not the fact that why hybrid car insurance are popular? It is because of the availability of the cheap fuel, tax returns or increasing in MPG. There may be many reasons behind this fact. But many experts are of the opinions that people should avoid the insurance. There are many other options and alternative that people can select instead of selecting hybrid insurance.

The major reason is that majority of the people are belonging to the middle class and they cannot afford the new car which is hybrid. There is an effective way that helps you create your won insurance. Nowadays people use HHO a add fuel in their vehicles. You must find the reason that why a hybrid car need a two or more than two fuel. But many experts also favor the insurance for hybrid car due to following reasons.

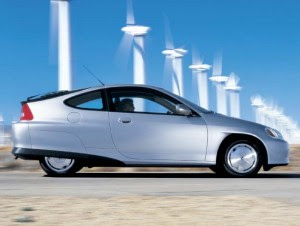

Hybrid vehicles are small in size and run efficiently than other vehicles. The major advantage is that when your hybrid car stops at the signal, engine automatically shut down and starts again when you apply gear to it. These types of cars work on the electric motor and the gasoline engine that make save your money spent in the consumption of fuel. Hybrid car engines are more efficient as these engines emit less smoke and give better mileage performance.

The battery of the hybrid car is made of the nickel-metal-hydride and it covers the long distance because of its high capacity power. There are many benefits of using car than the traditional car and it also saves you environment from pollution. Before getting insurance for hybrid car, you should search out the best insurance company. Many firms are providing insurance for hybrid car at affordable prices.